The XRP price is enjoying a great deal of attention right in the market. Many traders feel hopeful since the price continues to stay in an upward trend. XRP is still on the strength and buyers are holding the token at key levels. This allows the overall mood to remain positive.

But, even with this positive outlook, one silent issue grows in the background. Some XRP holders in the long run have started to sell more than usual. Their action casts doubts on how long such a rally can last. When insiders or long-time holders back off in their holdings, traders are often interested. Their behavior is sometimes telling early before the rest of the market reacts.

In this article, you will get to know why does the XRP price look strong today, why is this market still hopeful, and why there is still insider activity that levels concern many traders. The objective is to keep everything simple so that every reader will be able to understand the current situation clearly.

XRP Price Moves Up as Market Shows Positive Signs

The XRP price continues to stay in a healthy zone. Buyers continue to show interest and short term trends do support the move. Many traders believe that the XRP has strong potential when compared to other cryptocurrencies. When the market is subjected to volatility, XRP is still able to maintain its composure. This brings a sense of confidence to the retail traders who prefer stability.

The upward movement is the result of a number of factors:

- More buyers enter the market

- Market sentiment improves

- Support levels stay strong

- Short-term holders continue accumulating

These points XRP has to keep in the positive direction. Even small gains get investors excited, particularly when the overall movement of the crypto market is sideways. The price action indicates that short-term trend is still in control of buyers.

But this is only one side to the story.

Short-Term Holders Help Keep the Price Stable

Short-term holders have a very significant role in why XRP has been as stable as it has in recent days. Usually, these holders become fast for sale when the market becomes uncertain. But at the moment, they continue to accumulate, which sends a positive signal. Their consistent interest indicates that they believe the price will be even higher.

These groups include those who hold XRP for:

- One week

- One month

- Up to three months

As they add more and more XRP to their wallet the total buying pressure rises. This way, the market is not exposed to sudden drops. Their actions prop up the current price and limit the selling of anxiety.

When short-term holders act in this manner, the market often has early strength. Traders view this as a sign of confidence and it attracts more buyers into the market. This creates a healthy pattern for upward movement.

Long-Term Holders Start Selling, Raising a Red Flag

While short-term holders help to keep the markets in check with their short-term holdings, long-term holders show the opposite behavior. These holders usually hold XRP for long periods and will sell only when they see good opportunities or they have a signal of a possible price drop.

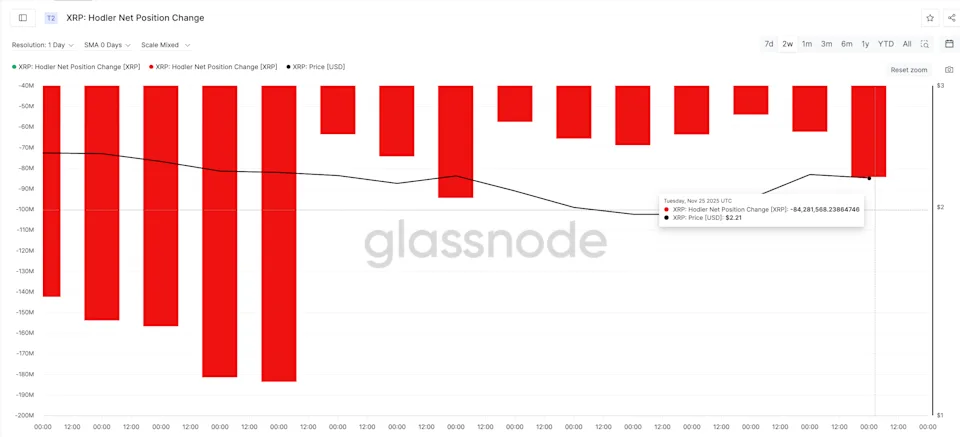

In recent days, these long-term holders have increased their sales. Their net outflows significantly increased. This sudden change generates a concern because the holders who have been in the market for a long time usually know the market well. Their activity often reveals early warning.

This increase in sales does not mean that XRP is going to crash. But this does show that some insiders or early buyers want to take profits. When this group makes more sales, the market should be on the lookout. Their decisions often have an impact on the next significant move in price.

Why Insider Activity Matters for XRP Traders

Insider activity refers to the behavior of holders who have a strong understanding of the token and hold it for a long time. Their actions are based on their faith in the future of the token. Once they are buying, confidence increases. When they sell, concerns grow.

Here is why the activity of them is important:

- They are in control of large amounts of XRP

- Downward pressure caused by their selling

- They tend to predict the direction of the market

- Other traders follow their indications

If those who are in it for the long haul continue to sell, there is a chance the market will lose momentum. Traders then become more apprehensive. Even strong buying by short-term holders cannot necessarily counterbalance the increased selling pressure.

This is why many experts consider long-term selling to be a red flag. It warns the traders to keep their eyes on the chart and not to make any emotional decisions.

XRP Faces Key Support and Resistance Levels

The XRP chart displays significant levels which are followed by traders. With these levels they gain an insight of where the price may move next. Right now, the price is near a strong support and resistance zone.

Key Levels to Watch

- Support: Around $2.06

- Lower Support: Around $1.81

- Resistance: Around $2.24

- Higher Resistance: $2.58 and $2.69

| Level Type | Price Level | Description & Significance | Potential Impact if Broken/Held | Key Metric/Data Point |

|---|---|---|---|---|

| Support 1 | $2.06 | Immediate buffer; short-term stability zone | Break: Sellers dominate, test $1.81; Hold: Sustains surge momentum | Short-term holder accumulation (up 15%) |

| Support 2 | $1.81 | Mid-term floor; previous consolidation | Break: Triggers broader sell-off; Hold: Enables bounce to $2.24 | Long-term outflows (net rise 20%) |

| Support 3 | $1.50 | Deep bearish target; historical low in volatility | Break: 25%+ drop, fear spikes; Hold: Signals reversal potential | Overall market sideways pressure |

| Resistance 1 | $2.24 | Near-term ceiling; breakout threshold | Break: Confirms buyer control; Hold: Caps optimism rally | Increased trading volume (healthy) |

| Resistance 2 | $2.58–$2.69 | Higher barriers; EMA alignment for upside | Break: Path to $3+; Hold: Reinforces insider concerns | Large wallet inflows (slight positive) |

| Current Price | ~$2.10 (as of Dec 12) | Fragile surge zone amid mixed signals | Monitor for $2.06 hold to avoid downside | Optimism drivers (Ripple partnerships) |

If the price remains above $2.06, the short-term trend is safe. If it breaks below, then sellers may gain control. In that case, XRP may like to test the lower support level at $1.81.

On the positive side if XRP could break above $2.24, that trend could become even stronger. This move may open the possibility for the next targets near $2.58 and $2.69. For this to take place, though, the market involves good buying from major holders.

Large Wallet Activity Shows Mixed Signals

Large wallet activity is also termed “big money flow” and is another way for traders to understand whether or not big investors support the rally. Right now, there is still a slight positive inflow overall, which means that some big investors are still buying.

But the inflow still remains below an important trendline. This means the strong support of the big investors is not even half back. Traders like to see this trendline break as it indicates new money entering into the market.

| Activity Type | Short-Term Holders (1–3 Months) | Long-Term Holders (Extended) | Large Wallet Signals | Overall Impact on Price |

|---|---|---|---|---|

| Behavior | Accumulating (buying pressure) | Selling (net outflows rising) | Slight positive inflows below trendline | Mixed: Optimism vs. red flags |

| Volume/Metric | +15% holdings; stable price control | 20% net sell-off; profit-taking | Weak support; potential for speedup if inflows grow | Surge sustained but vulnerable |

| Price Influence | Supports upward trend; confidence boost | Raises concerns; downward pressure | Limited momentum; needs stronger inflows for breakout | Hold $2.06 key for rally continuation |

| Trader Takeaway | Bullish signal; enter on dips | Watch for escalation; set stops | Monitor for shifts; diversify 20% | Balanced but caution advised |

If there is an increase in large inflow of wallets, XRP could potentially break above resistance faster. But if inflows remain weak, the price may not be able to hold its momentum for long. This makes the current stage important to watch.

Market Optimism Still Drives XRP Forward

Even in the face of insider selling, the broad market remains optimistic. Traders believe that there is still room for XRP to grow. Many forecast bigger moves when temporary noise in the market is cleared.

Multiple factors contribute to this optimism:

- Crypto activity is on the rise

- Bitcoin remains stable

- Ripple continues to grow internationally

- New traders join the market

- The price structure of XRP remains healthy

Market optimism is not a guarantee of a good rally, but it helps to promote the idea that demand for XRP is still alive. As long as the market remains positive, then XRP may continue to benefit.

Don’t Miss XRP Price Prediction 2025-2030: Can Ripple Break Above $6 After the Next Major Market Catalyst

But Traders Must Stay Alert Because Signals Are Mixed

Mixed signals need to be taken care of. On one side, the level of the XRP price remains solid and there is belief among short-term holders. On the other side, the long-term holders are still managing to sell off, and large inflows from wallets are still limited.

This brings a balance between hope and concern.

Traders don’t have to be worried, but should beware. Mixed conditions are often the cause of sudden price fluctuations. When traders know both sides they can make better decisions and avoid emotional moves.

Should Traders Worry About Insider Selling?

The insider selling does not mean that XRP is going to fall sharply. But it does indicate that some big holders are perked on taking the profit. Profit-taking is normal in any market especially after a strong rally.

Still, this selling does become a concern when:

- It keeps rising

- It lasts for many days

- It happens during a key trend

- It utilizes predicting past patterns before a drop

At the moment, XRP has early warning signs. Traders need to be aware of how this pattern develops for the next few days. If commerce in selling gets slower, the rally may persist. If there is a growth in selling, there may be new pressure on the price.

Why XRP Still Holds Strong Future Potential

Even with the concerns, XRP continues to have good appeal in the long-term. Many traders believe that the token has value due to its real-world use. XRP facilitates fast and low-cost payments and there are numerous global partners that trust Ripple’s technology.

Several points are in favor of the long-term strength of XRP:

- Strong community support

- Increasing usages in payment systems

- Expanding partnerships

- Rising market visibility

- Healthy trading volume

This long-term picture helps to reduce the fear in case of short-term concern. Many investors are confident in the currency because they believe that it can grow in the future.

What XRP Traders Should Focus on Next

To stay safe and make smart decisions, the traders should be on the lookout for a few areas:

- Price Support Around $2.06: If XRP holds this level, then the trend remains positive.

- Resistance at $2.24: In case XRP breaks this level, there is a possibility of a strong rally.

- Long-Term Holder Activity: If there is a deceleration in selling, fear will subside.

- Large Wallet Inflows: The more inflow, the more support for a breakout.

- Market Sentiment: Market sentiment is positive to keep XRP having good days.

By monitoring these areas, traders can avoid being surprised by any moves and be ready for an upward or downward shift in movement.

Final Thoughts: XRP Shows Strength, But Caution Remains Wise

The XRP price experiences a great period and market optimism contributes to additional growth. Short-term holders are confident, and the market is positive, and support levels remain intact. This helps to keep the overall picture healthy.

But, insider activity raises concerns. Long-term holders are increasing their selling and the large wallets are not yet showing much inflow. These signs create caution on traders who want a clear and safe trend.

Right now, XRP is at an important point. Depends on the reaction of buyers and whether the selling slows down. Traders should always stay up to date, watch key levels and stay away from guesswork.

XRP still has great potential, but wise trading involves hope and caution at the same time.

If you want to earn with crypto, go through our guide New Year Crypto Goals: Earn $1000/Month

Also read: Ripple XRP News: SEC Case Update