XRP continues to remain at an important price level. The token trades near $1.90 level, and traders across the US and worldwide continue to keep a very tight eye on this zone. Many analysts think that bulls need to defend this level in order to prevent a bigger fall. Some experts are even warning that XRP is heading towards $1.00 as the selling pressure increases.

In this guide, we take a closer look at the situation with the help of some simple language. You will know what this price level means, why analysts are concerned about it and what traders need to expect from next. You’ll also learn about the role ETF inflows, whales, retail traders, and technical indicators play in shaping XRP’s path.

Let’s break everything down step-by-step.

XRP trades near a key support zone

Right now, XRP trades near $1.90 to $1.92. Traders refer to this area as a support level. This implies that the buyers have a tendency to step in around this price. With continued strength for the buyers the price often holds. When the buyers are losing strength, the price often breaks below the level.

Bulls are interested in defending this support. They would like to hold the price above $1.90 and prevent the market from falling into a deeper decline. Bears want the opposite. They would like the price to breakdown and move down to the next major support zones.

So the market looks tense. The eyes of both sides watch each move. A change in momentum, however small, could cause more massive movements.

Analysts warn about a possible drop toward $1

Many analysts warn that XRP may fall even lower if the price falls below $1.90 and remains there. Some experts anticipate a potential fall to $1.00. They believe that the current market exhibits risk because:

- XRP has already fallen from highs around $3.60+ earlier this year

- Overall Crypto feelings show weakness

- Traders display fear and uncertainty

- Large holders are still selling in some periods

These signals put pressure on the market. Bulls have the line for now, though analysts are still cautioning buyers to be cautious.

ETF inflows show institutional interest but not guaranteed support

Although faced with the risk to its price, Exchange traded funds (ETFs) for XRP continue to see inflows. These products enable institutional investors to get an exposure to the XRP via regulated markets. Recent statistics indicate stable flows into these ETFs over days.

This trend is a good indicator that there are still institutions who are invested in XRP. Many see far longer term value in the asset and they keep accumulating.

However, inflows alone cannot ensure that the price will rise. Markets are still dependent on larger trends, the retail demand and sentiment, and risk conditions.

So, ETF inflows help support market confidence however, it does not move downside risk completely.

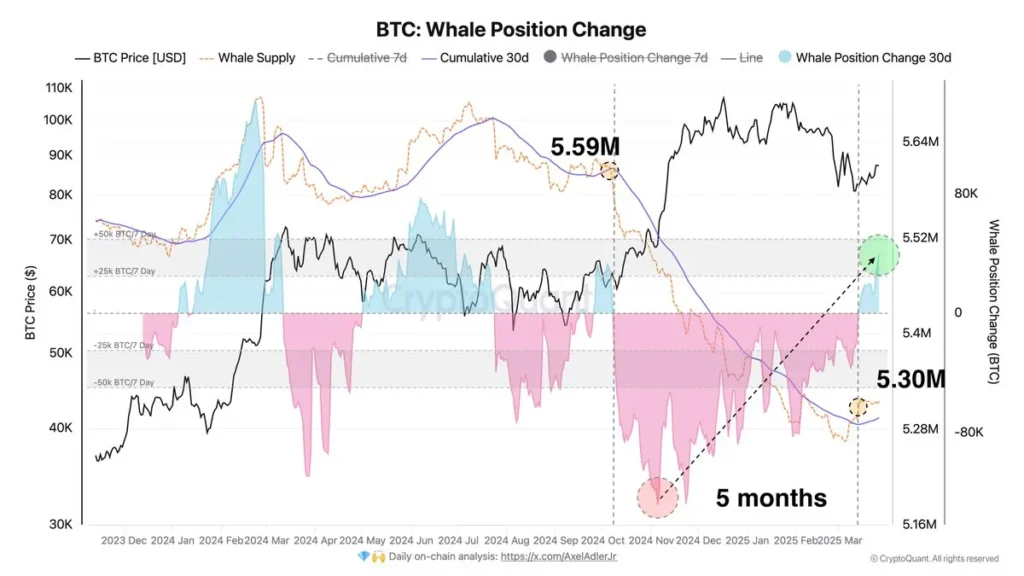

Whales continue to play a major role

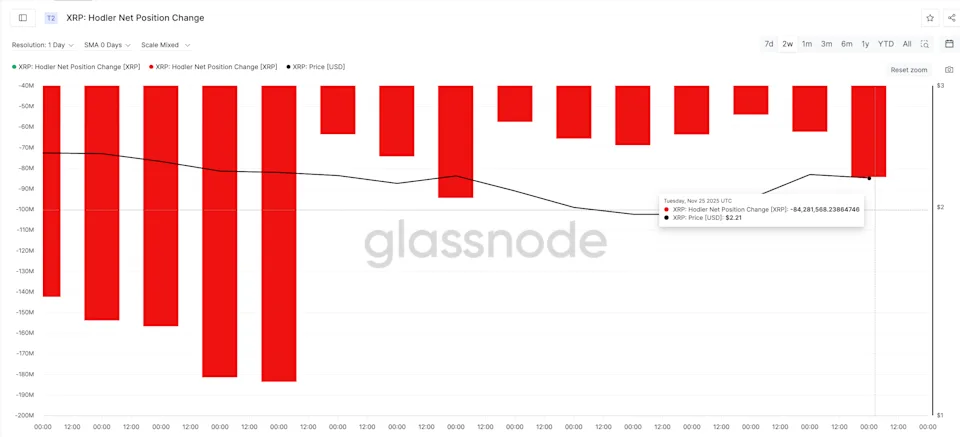

Large XRP holders, also known as whales, control a significant portion of the supply. Analysts follow whale activity closely because whale activity often has an impact on price direction.

There have been reports in recent weeks indicating that whales have shifted billions of XRP worth of shares in several weeks. This selling pressure caused a concern in the market and helped push the price lower towards current levels.

At the same time, some whales are still being accumulated. This mixed behavior leads to uncertainty. Bulls wish that accumulation increases. Bears hope that selling will continue.

Retail traders are now more focused on whales since their behavior often leads to price trends.

Retail interest remains weak compared to earlier peaks

Retail traders used to control the XRP markets. Many traded heavily when prices were skyrocketing in the earlier part of the year. Today, interest looks weaker.

Open Interest in Futures Markets fell from previous high levels. This means that there are fewer traders who have active leveraged positions. Lower Open Interest can often signal low confidence and weaker momentum.

For bullish traders that presents a challenge. No other factor contributes as strongly to rallies as good retail demand. Without it, the price rebounds may have a hard time gaining strength.

Technical indicators still point to pressure

Technical Indicators are also sources for warning signs. XRP trades below several important moving averages such as the 50-day, 100-day and 200-day EMAs. In times that price trades below these levels, analysts often view that the market is in a bearish phase.

Momentum indicators also indicate weakness. RSI stays below the mid-range. MACD signal shows level of bearish pressure. Trend lines also show that there is resistance at approximately $2.00 to $2.50.

So bulls suffer from several barriers. They must first protect $1.90. Then they need to win back zones of higher resistance to turn things around.

Key support and resistance levels to watch

Here are the key price levels that traders still keep an eye on:

Support levels

- $1.90 – immediate key zone

- $1.82 – near-term demand region

- $1.61 – deeper support

- $1.00 – major psychological support

Resistance levels

- $2.00 – psychological barrier

- $2.18 – 50-day EMA area

- $2.36 – 100-day EMA

- $2.43 – 200-day EMA

- $2.52 – descending trendline zone

Bulls will need to break above these levels in order to regain control.

XRP still holds long-term interest

Even with near-term risk, the XRP has long-term investors. Many think XRP could have a role in cross-border payments and institutional finance. Ripple is still seeing more and more partnerships grow and the regulatory clarity for them keeps improving.

Some traders look at the declines as buying opportunities. Others prefer to wait until trends again turn positive.

No strategy suits everyone, so investors continue to make decisions based on their risk tolerance as well as time period.

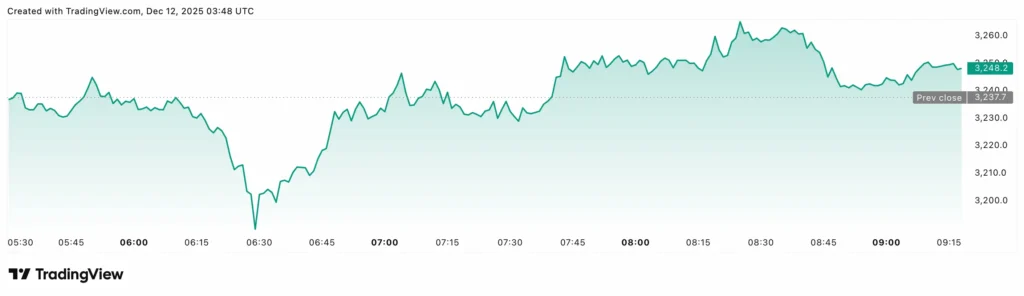

Macroeconomic uncertainty still affects crypto markets

Crypto markets do not move in isolation. Global economic conditions continue to affect the direction of prices. Rising interest rates, concern over inflation, changes in political items and risk feelings all influence investor behavior.

In the event of fear, many traders lessen exposure to crypto. Altcoins are first harmed by this behavior. XRP is a part of that group and as a result, the token usually has a great affinity to the fear within the market.

Sentiment remains mixed across the market

Market sentiment since looks very divided. Bulls believe XRP can rebound if support holds. Bears provide warning of deeper slides. ETF inflows provide hope. Whale selling creates fear.

This combo creates sideways action and choppy movement. Volatility and abrupt price movements are to be expected by traders.

What happens if XRP holds above $1.90?

If bulls defend the $1.90 level successfully:

- Buying activity may be increased

- Confidence by traders may be renewed

- Short-term rebounds may form

- Price may move back toward $2.00+

- Medium-term support increases

A strong bounce could indicate renewed bullish energy.

What happens if XRP breaks below $1.90?

If bears push price below $1.90:

- Support weakens

- Traders may panic sell

- Bears may gain control

- Price could be $1.80, $1.60 or even $1.00 lower

This step would probably cause fear throughout the market.

Risk management matters now more than ever

Traders must stay careful. Sudden price shocks can occur at any point in time. Smart traders:

- Have definite entry and exit levels

- Avoid making decisions that are emotional

- Use position sizing

- Track news and data

- Stay patient

Simple discipline often makes control over traders rather than guessing the short-term price movements.

Long-term holders may ignore short-term volatility

Many long-term XRP believers are holders through the cycles. They focus on adoption, legal clarity, partnership and utility. They are anticipating volatility and they take price-games as part of the journey.

Short-term traders, however, are concerned with time. They observe everything for almost $1.90.

Both groups shape the market, which they create together.

Final outlook: Can bulls defend $1.90?

Right now, $1.90 remains the key battleground. Bulls continue to defend it. Bears continue to test it. Analysts are warning of a potential decline down to $1.00 support. ETF inflows provide optimism, but can’t eliminate risk.

So the market is in balance between fear and optimism.

If you follow XRP, you should:

- Watch support levels

- Track institutional flows

- Monitor whale activity

- Stay tuned to wider crypto trends

Most important is to stay informed and have a calm and thinking approach.

Crypto markets can move rapidly. Smart investors stay ready.

Don’t miss: Dogecoin Price Prediction 2026

FAQs

Why is the $1.90 level important for XRP?

The $1.90 level serves as a key support zone for XRP. This means the buyers often enter the market around this price. If the price of XRP remains above $1.90, the price would remain steady or move in the upward direction. If XRP dips under $1.90 and remains there, then the price might continue down to lower support.

Could XRP really fall to $1?

Yes, according to some analysts, some of which believe that XRP will drop to the $1 range if the price falls below $1.90 and selling pressure rises. This scenario is subject to many variables, including market sentiment, whale activity, ETF flows and overall crypto performance. It is not a guarantee but it is still a risk.

Do ETF inflows help the XRP price?

ETF inflows indicate that institutional investors continue to purchase XRP through regulated funds. This is a trend that is often supportive of demand. However, inflows alone do not necessarily cause price increases. Other forces of the market, like selling pressure and low interest from retail, still influence XRP.

Why are whales important in XRP price movement?

Whales hold very large amounts of XRP. When whales make purchases, the market may gain strength. When whales sell, the price may go down. Analysts monitor the whale wallets because they track where big investors shift their money since it can often shift the direction of markets.

Is XRP still a long-term investment opportunity?

Many long-term investors still have faith in XRP due to the payments with other countries and banking partnerships. However, the price may remain volatile. Long-term investors tend to pay attention to adoption and utilities and not short-term price swings.