Bitcoin, the world’s first cryptocurrency, continues to be the most popular and valuable digital asset even in 2026. Whether you’re curious about investing, want to diversify your portfolio, or simply want to understand the hype, buying your first Bitcoin can feel overwhelming.

The good news? It’s easier than ever. With dozens of secure platforms, user-friendly apps, and a wealth of learning resources, purchasing Bitcoin is now accessible to anyone with a smartphone and an internet connection. This guide will walk you through the entire process step by step, explaining everything from choosing the right exchange to securing your coins safely.

Before You Buy: Understanding Bitcoin and Staying Safe

Bitcoin is a decentralized form of digital money that runs on a transparent public ledger called the blockchain. It is not controlled by any single government or bank, which makes it unique compared to traditional currencies. With a fixed supply of 21 million coins, Bitcoin is often referred to as “digital gold” and is increasingly viewed as both a store of value and a payment method.

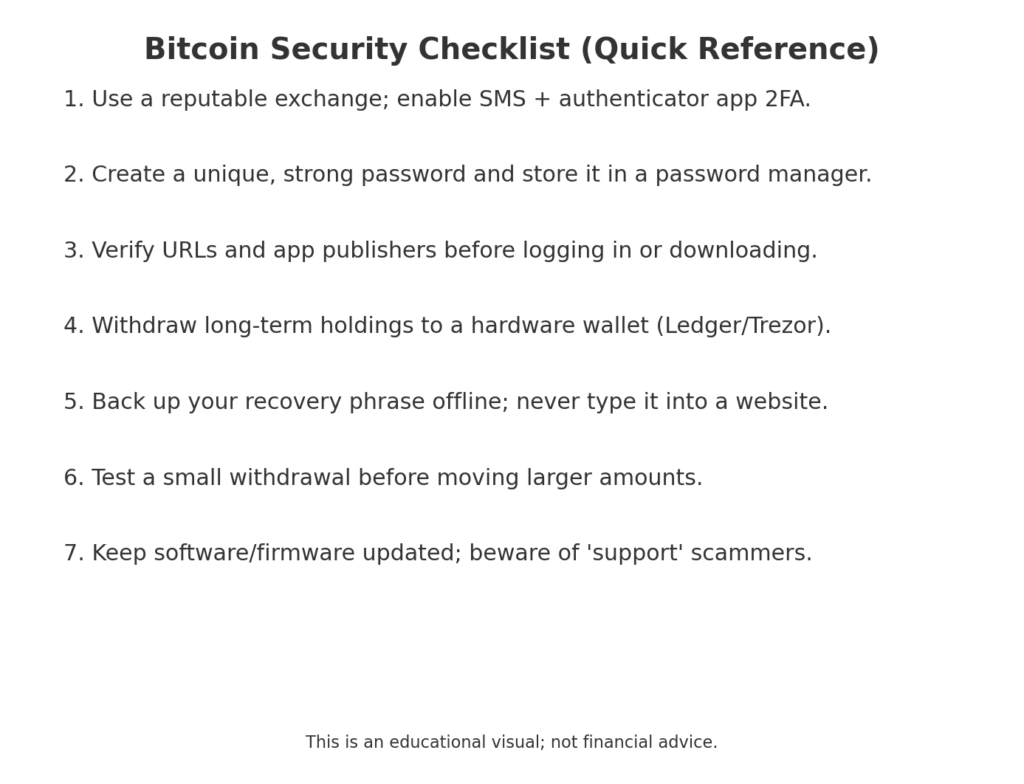

Alongside its potential benefits, Bitcoin comes with risks. Prices can be volatile, and if you mishandle your private keys or recovery phrase, you could permanently lose access to your coins. That’s why learning about wallets, exchanges, and basic security measures is essential before you buy.

Why Buy Bitcoin in 2026?

Before jumping into the how-to, it’s worth asking: why should someone consider buying Bitcoin today?

- Store of Value: Bitcoin is often compared to digital gold. While traditional currencies lose value over time due to inflation, Bitcoin has a capped supply of 21 million coins, making it scarce and potentially valuable over the long term.

- Growing Adoption: In 2026, more businesses, payment platforms, and even countries will be integrating Bitcoin into their financial systems. From coffee shops to real estate, Bitcoin is becoming a mainstream payment option.

- Portfolio Diversification: Investors increasingly treat Bitcoin as an alternative asset class, balancing traditional stocks, bonds, or gold with digital currencies.

Learn the Basics

Before you invest, take time to understand what Bitcoin is and how it works. At its core, Bitcoin is decentralized digital money that operates without banks or governments. Transactions are verified on a blockchain, which is essentially a transparent, secure, and permanent digital ledger.

You don’t need to be a tech genius, but having a grasp of terms like “wallets,” “private keys,” “blockchain,” and “exchanges” will save you from mistakes.

Choose a Secure Cryptocurrency Exchange

The first practical step in buying Bitcoin is selecting a cryptocurrency exchange. This is the platform where you buy, sell, or trade Bitcoin. In 2026, the most popular and reliable exchanges include

- Binance (global presence, low fees)

- Coinbase (simple and beginner-friendly)

- Kraken (highly secure with a wide coin selection)

- WazirX (popular in India)

- Bitstamp (trusted since 2011)

When choosing an exchange, consider:

- Security features (two-factor authentication, insurance policies).

- User experience (easy to navigate apps/websites).

- Payment options (bank transfer, UPI, debit card, etc.).

- Regulatory compliance in your country.

Set Up and Verify Your Account

Once you’ve chosen an exchange, the next step is to register. This is similar to creating an account on any financial platform.

- Sign Up: Enter your email ID, create a password, and verify your email.

- KYC Verification: Most exchanges now require identity verification. Upload documents like your passport, Aadhaar card, or driver’s license. This ensures compliance with anti-money laundering laws.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of protection by requiring a code from your phone in addition to your password.

Add Funds to Your Exchange Wallet

Before buying Bitcoin, you’ll need to deposit money into your account. Most exchanges allow multiple funding methods in 2026:

- Bank Transfers / UPI (India-specific)

- Debit or Credit Cards

- Third-party payment apps like PayPal

- Wire transfers for large investments

Each method has different processing times and fees. Bank transfers often have lower fees, while cards are faster but slightly more expensive.

Buy Your First Bitcoin

Now comes the exciting part: purchasing Bitcoin.

- Log in to your exchange account.

- Select Bitcoin (BTC) from the list of cryptocurrencies.

- Choose “Buy” and enter the amount you want. Remember, you don’t have to buy a full Bitcoin; you can buy a fraction, such as 0.001 BTC.

- Confirm the Transaction. Review fees, double-check details, and finalize your purchase.

Congratulations! You now own Bitcoin.

Store Your Bitcoin Safely

Keeping your Bitcoin safe is just as important as buying it. Leaving coins on exchanges is risky because hacks and scams are still possible. Instead, move your Bitcoin to a crypto wallet.

- Hot Wallets (Software Wallets): Apps or web wallets, convenient for everyday use but more vulnerable.

- Cold Wallets (Hardware Wallets): Physical devices like Ledger or Trezor that store your coins offline, offering maximum security.

Always back up your private keys and never share them with anyone. Remember: if you lose your private key, you lose access to your Bitcoin permanently.

Decide on a Buying Strategy

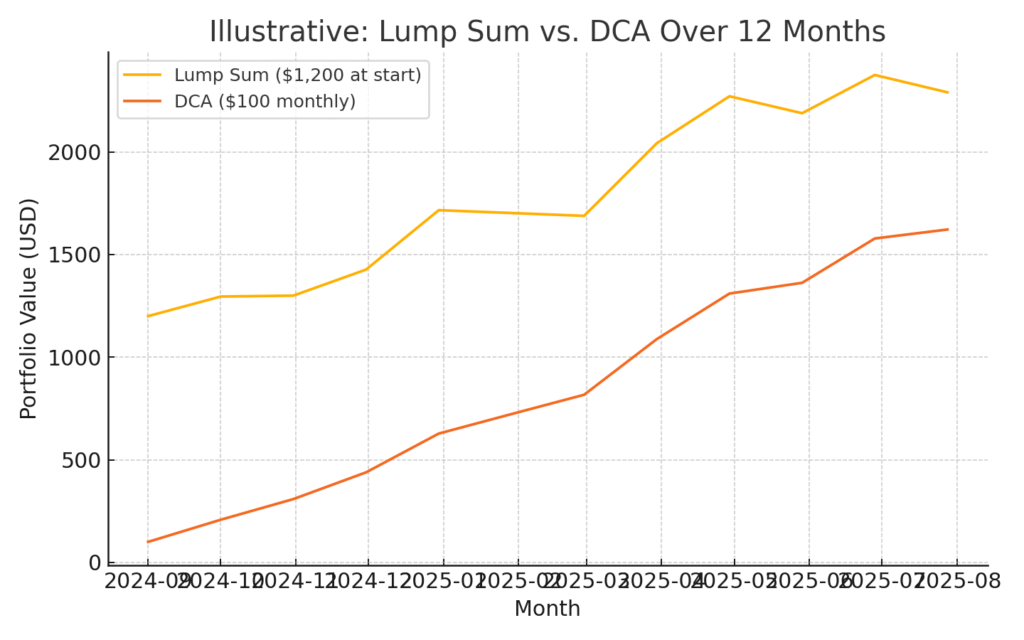

Bitcoin’s price fluctuates daily, which makes timing your purchases tricky. Beginners often choose between two strategies:

- Lump Sum: Invest all at once. This can work well if the market rises, but it leaves you exposed to short-term volatility.

- Dollar-Cost Averaging (DCA): Invest smaller amounts regularly, such as weekly or monthly. This strategy smooths out volatility and reduces the pressure of trying to “time the market.”

Learn to Monitor and Manage Your Investment

Owning Bitcoin doesn’t mean you should stare at price charts all day. Instead, focus on:

- Market Trends: Use apps like CoinMarketCap or TradingView.

- Dollar-Cost Averaging (DCA): Invest small amounts regularly instead of trying to time the market.

- Long-Term Mindset: Many investors “HODL” their Bitcoin, holding it through ups and downs.

Common Mistakes Beginners Should Avoid

- Investing More Than You Can Afford: Only invest what you’re comfortable losing.

- Falling for Scams: Avoid offers that promise guaranteed profits or fake giveaways.

- Skipping Security: Not enabling 2FA or neglecting cold storage can cost you your coins.

- Panic Selling: Crypto is volatile. Prices rise and fall quickly; don’t let emotions guide your decisions.

The Future of Bitcoin in 2026 and Beyond

Bitcoin has now been around for more than 15 years and has grown into a recognized global asset. In 2026, adoption continues to rise, with more businesses accepting Bitcoin as payment and governments exploring digital currencies. While its price remains volatile, its role as a store of value and alternative investment is becoming more established.

As regulations mature and institutional adoption grows, Bitcoin is likely to remain a significant part of the global financial ecosystem. Buying your first Bitcoin today is not just about holding a digital coin; it’s about participating in a financial system that operates outside traditional boundaries.

Buying Bitcoin in 2026 is far simpler than it was a decade ago. With secure exchanges, mobile apps, and hardware wallets, even a complete beginner can get started within minutes. The key is to move carefully: educate yourself, start small, prioritize safety, and think long term.

The cryptocurrency journey may seem intimidating at first, but once you buy your first Bitcoin and understand how it works, you’ll realize you’re participating in one of the biggest financial revolutions of our time.

Read also: Bitcoin Faces $105K Support as Holders Sell