Ethereum shows signs of recovery following the fall close to the $2,600 level this week. The price bounced almost 10% and generated hope for buyers. The chart even shows small positive movements on a day-to-day basis. However, the bigger picture of the trend still appears to be weak. New data is now revealing the presence of a major problem building at the background level. Long-term holders have suddenly been more than 300% selling in a single day.

This sharp spike in selling pressure is joining another strong bearish signal, that of an almost-confirmed death cross on the Ethereum chart. When both signals appear together, the probability for a deeper decline is greater. Due to this, Ethereum’s next big price move is at serious risk these days.

In this article, you will understand why selling pressure has jumped so fast, what a death cross means and how these two signals combined threaten Ethereum’s, short-term and long-term direction. You will also learn about Ethereum’s major support and resistance level so that you could track the next possible move clearly.

Understanding the 300% Spike in Selling Pressure

Long-term holders, also known as “hodlers,” typically keep their Ethereum locked for extended periods. These wallets usually do not indulge in sudden trading activities. Because of this, any major change in their behavior provides an early indication of the direction of the market in the future.

This week, on November 22nd, long-term holders sold approximately 334,600 ETH. But on November 23, the selling went off to 1,027,240 ETH. That is a huge increase of 300%, in just one day. This is represented by a sudden swing which indicates fear, uncertainty or loss of confidence from the part of investors who are normally patientGBT.

Such a massive burst of selling makes for massive supply to the market. When the supply rises quickly and the demand remains constant, prices will generally decline. This is what precisely makes traders now worried about the next move of Ethereum. Selling pressure never comes from new traders. It is from experienced holders who are usually waiting for long-term returns.

When long-term wallets are sold in such large quantities it is often indicative of a shift in the belief of the market. This shift is typically seen before the full impact of it shows up in the price. That means that the current bounce may only be temporary.

Glassnode Report Indicates Ethereum Holders Move Coins More Frequently Than Bitcoin’s

Why Long-Term Holders Matter So Much

Long-term holders have a strong influence on price stability. When they are held confidently, the market remains stable. When they lower their positions, the market becomes weak.

Here is why their signals matter:

1. They hold a large supply

Long-term wallets often have enormous quantities of ETH that are controlled. Even a slight change in their behavior can make big moves in the market.

2. Their selling shows fear or strategy change

These investors do not sell for quick profits. When they sell in big numbers, they tend to be expecting more downside.

3. Their actions often happen before major price shifts

Hodler activity leads to early warnings prior to charting trouble.

This week’s 300% jump in selling is a clear message that many of the long-term holders want to get out before things get more deeply depressed. That message alone puts the current recovery in jeopardy.

The Looming Death Cross: Another Major Bearish Signal

Along with the selling, there is another danger that Ethereum faces. A death cross is just around the corner on the daily chart. A death cross occurs when the Exponential moving average (EMA) 50 day crosses below the 200 day EMA. This crossover indicates strong downward momentum.

Here is what makes the situation even worse:

The spike in selling pressure by 300% is seen at the same time the death cross is forming. This means that both signals are now supporting each other.

Why a death cross matters

A death cross usually indicates:

- Sellers have more control

- Buyers find it difficult to raise price

- Downtrend Pressure Strengthens

- Recovery attempts are frequently unsuccessful

When the 50 day EMA crosses under the 200 day EMA, the chart illustrates a case of long-term weakness. Traders would usually take this as a significant bearish signal.

Why both signals together create a stronger threat

The selling pressure from holders is a fuel for the death cross warning. It pushes the price down, at the exact point when the EMAs cross to the negative. Due to this, Ethereum has a greater risk of retesting lower support zones.

This combination hardly occurs without stronger price movement thereafter. So it is now expected to be more volatile in the days ahead to come for traders.

Ethereum Price Action (Death cross): A Fragile Bounce Under Heavy Pressure

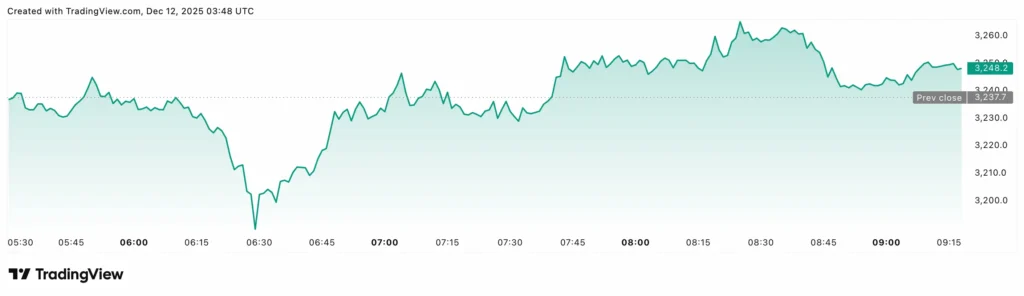

Ethereum is trading close to $2,820 at the moment. The bounce off the $2,600 zone appeared to be positive. However, the chart is showing more resistance above the price than support below the price. The recovery looks fragile.

Ethereum needs to guard against another massive decline against key support zones.

Understand What is a Death Cross?

Key Support Levels Ethereum Must Hold

| Level Type | Price Level | Description & Significance | Potential Impact if Broken/Held | Key Metric/Data Point |

|---|---|---|---|---|

| Support 1 | $2,710 | Fibonacci 0.786 retracement; immediate downside buffer | Break: Triggers panic selling to $2,450; Hold: Stabilizes short-term bounce | 300% spike volume (1M+ ETH sold) |

| Support 2 | $2,450 | Mid-term floor; previous consolidation zone | Break: Confirms death cross downtrend; Hold: Allows recovery to $2,820 | EMA 50/200 cross confirmation |

| Support 3 | $1,700 | Deep bearish target; historical low in extended sell-off | Break: 40%+ drop, fear index spikes; Hold: Rare reversal signal | Long-term holder supply dump (43% since July) |

| Resistance 1 | $3,190 | Near-term ceiling; recent high from bounce | Break: Signals buyer control; Hold: Caps upside amid selling | Increased exchange inflows (8.7% low) |

| Resistance 2 | $3,660 | Major psychological barrier; EMA 200 alignment | Break: Path to $4K recovery; Hold: Reinforces seller dominance | Death cross momentum (bearish EMA shift) |

| Overall Risk | $2,820 (Current) | Fragile bounce zone; 300% selling vs. low demand | Monitor $2,710 closely for next move | Fear & Greed Index: Extreme Fear (current) |

1. Strong Support at $2,710

This is the most crucial support level at the moment. It sits at the 0.786 Fibonacci zone. If Ethereum falls below this zone, then again sellers have full control.

A break below $2,710 usually is the initial step of a deeper correction. For this reason, many traders pay close attention to this level.

2. Major Breakdown Support at $2,450

If $2,710 fails, Ethereum may drop towards $2,450 which shows a possible 13% drop from current levels. This level is of historical buying interest. But if the death crosses it out selling pressure stays high ethereum hits this level faster than expected.

3. Extended Downside Support at $1,700

If selling continues to be strong and the trend continues to pick up steam then ETH could test the $1,700 region again. This level hooks up to long term trend extensions. This scenario only becomes possible if the market does become very bearish.

For now, Ethereum’s action in holding above $2,710, defines the next big move.

Key Resistance Levels Ethereum Must Break for a Real Recovery

Ethereum cannot manage to show real strength unless it breaks strong resistance zones. These levels prevent the price from going up.

1. First Major Resistance at $3,190

Ethereum needs to recoup $3,190 to become visible signs of recovery. Without breaking this level, this bounce remains weak.

2. Stronger Resistance at $3,660

Ethereum has to move above $3,660 to confirm a genuine trend reversal. This level is a selling reversal pointing to the strength and confidence coming back to the market. However, it does appear difficult to get to this point under the current bearish conditions.

Until ETH pushes above these zones, sellers are stronger than buyers.

How the Selling Spike Impacts Short-Term Market Sentiment

A sudden 300% increase in selling is more than an increase in supply. It also alters the conduct of traders and market forces.

1. Traders turn cautious

Short-term buyers are now concerned about getting in too early. Many wait for a clearer bottom.

2. Small investors follow long-term holders

When long-time holders sell they are often copied by smaller investors. This brings in even more selling pressure.

3. Fear index rises

Sudden selling from large investors would typically boost fear and panic in the market.

4. Volume increases in the wrong direction

Stronger selling volume makes the rise in price more difficult.

These changes add extra risk to the bounce in Ethereum and give higher possibility of a deeper drop.

How Traders Can Interpret the Current Signals

Both beginner and experienced traders like to know how to move on during uncertain times. These indications provide some useful lessons.

1. A bounce in a downtrend is never fully safe

The price may initially rise temporarily, but the trend is still in control of the market.

2. Heavy selling from holders is not random

Large holders are often quick to act. Their actions indicate genuine concerns.

3. A death cross often brings more declines

This signal is the warning that there is currently a market momentum in favour of sellers.

4. Protecting support levels becomes very important

Once strong support breaks, price often falls fast.

5. Recovery needs strength, not just a small bounce

ETH must take back major resistance to display real improvement.

These points help the traders understand the direction of the market and remain prepared for the different results.

What Could Happen Next for Ethereum?

The future direction is determined by the interaction of Ethereum with the support and resistance zones.

Scenario 1: Ethereum Breaks Below $2,710

If there remains a high selling pressure:

- Price may fall toward $2,450

- Market fear may increase

- Sellers could get full control

- The death cross may confirm the down trend

This scenario appears probable if selling from hodlers persists.

Scenario 2: Ethereum Holds Above $2,710

If there is stability in the market:

- ETH may try performing another bounce

- Price may move toward $2,950-$3,100

- Buyers get short-term confidence

However, the bounce continues to meet some strong resistance in front of them.

Scenario 3: Ethereum Reclaims $3,190

If buyers push strongly:

- Market sentiment improves

- ETH may target $3,660

- Selling pressure may reduce

This scenario seems less plausible when using the present data.

| Scenario | Trigger Condition | Short-Term Price Target | Long-Term Outlook (Q1 2026) | Probability (Est.) & Risk Factors |

|---|---|---|---|---|

| Bearish Breakdown | $2,710 support breaks; death cross confirms | $2,450 (13% drop) | $1,700–$2,000; extended downtrend | High (60%); 300% holder selling + macro fears |

| Neutral Consolidation | $2,710 holds but no $3,190 break | $2,820–$2,950 (sideways) | Stagnant at $3K; low volatility | Medium (30%); balanced supply/demand |

| Bullish Reversal | $2,710 holds + volume shift to buyers | $2,950–$3,100 (10% bounce) | $3,660+; path to $4K recovery | Low (10%); Needs institutional inflows to counter spike |

| Overall Market | Combined selling pressure + technicals | High volatility expected | Monitor EMA cross for $7K+ potential | Balanced but seller-dominant now |

Why the Current Market Needs Close Attention

Ethereum remains in a sensitive position. The 300% increase of selling pressure is not seen frequently. When it does it almost always causes strong movement in the following days or weeks. The death cross does contribute more weight to the bearish outlook.

The combination of both signals indicates Ethereum is in serious risk in the near term. Traders should pay attention to chart levels and not make assumptions. A bounce can be attractive, but the larger trend continues down.

Don’t miss 2025 Crypto Market Recap: Winners & Losers

Conclusion

A 300% spike in selling pressure puts Ethereum into a dangerous position. Long-term holders are rarely selling in such quantities and if they are this confirms fear and anticipation of more downside. The near-confirmed death cross adds more pressure and it warns that the downtrend is still strong.

Ethereum must shore up the $2,710 support level in order to prevent a deeper drop. If it fails, the price could slide to $2450 or lower. On the other hand, real recovery can only start when ETH recovers $3,190 and later $3,660. Until now, the sellers still hold more power.

The market is now waiting for the next big move for Ethereum. The bounce appears to be weak, the risk appears to be high, and the selling pressure appears to be stronger than ever.